The price of sanitary protection

You may remember the media episode of the “pink tax” which unleashed passions in 2015. Following this, the VAT rate for essential feminine hygiene products, until then taxed as much as products luxury, had gone from 20 to 5.5%. However, the price of periodic protection continues to be debated in France and around the world.

What is the “pink tax” again?

The term “pink tax” was coined to refer to the difference in price between hygiene products intended for women and those intended for men. Many collectives and associations have denounced the fact that distributors were offering higher prices in the women's section: razors, shaving foam, deodorants, etc.

Ara cotton menstrual panties

The price of dry cleaning and hairdressing have also been the subject of strong criticism. The maintenance of women's blouses is systematically more expensive than that of men's shirts. The same goes for hairdressers: for a woman with short hair, the price of a shampoo and a cut is around 50% higher than for a man. However, in both cases, the working time is the same.

While it may be difficult to ask a dry cleaner employee to align their prices consistently, it is possible to act on gendered marketing by simply ignoring the choices it tries to impose on us. After all, if men's razors are cheaper, why buy pink ones? We must never lose sight of the fact that consumers have enormous power through their purchases. Each of them is a real message sent to the manufacturing company and its marketing departments.

0% VAT for hygienic protection?

The debate on menstrual poverty was recently relaunched by a young homeless woman. By denouncing the lack of help regarding menstruation management among homeless women, she highlighted the financial difficulty experienced by a much broader population: students, single mothers or all other women struggling to cope. make ends meet.

Today, this young woman continues her fight by demanding a total absence of VAT on periodic protection (tampons and sanitary napkins), first in France, then throughout Europe. It shows as an example some countries that have already made the decision successfully: Nigeria, Kenya, Canada and Australia. Let us remember, however, that France is not the worst off either. In Germany, VAT is 19% for these products, and in Hungary, it reaches 27%!

But would that be enough? Indeed, during the VAT reduction in 2015, we noted that many brands of sanitary protection had barely, if at all, lowered their prices. Consumers were therefore not really able to benefit from this new legislation which was perceived as a gift given to the companies concerned which simply increased their margins. If non-taxation is finally obtained, numerous checks will have to be carried out to verify its application.

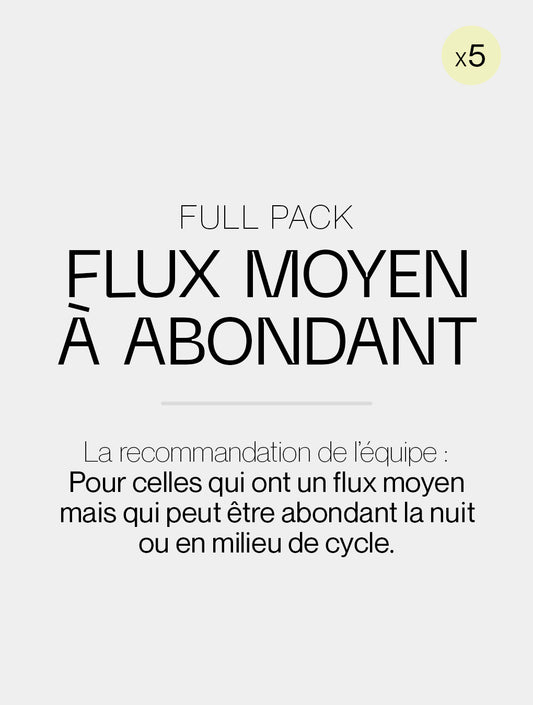

We naturally ask ourselves another question in this regard: why are reusable protections such as period panties , the cup or washable napkins still taxed at 20%? However, these products have exactly the same purpose as tampons and disposable sanitary napkins: allowing women to protect themselves during their menstruation. It is also a healthy, ecological and economical alternative in the long term. Why does legislation not promote its access and development?

By Emilie